- Tourism Visa

What You Need To Know About Saudi Visa Insurance

Medical and travel insurance is a must if you’re traveling to Saudi Arabia. Here’s what you need to know.

Introduction

Travel and medical insurance are a must for any traveler, no matter which part of the world they’re headed to. It provides that peace of mind that should you have an accident or suffer an illness, you’ll have coverage for any hospital or medical expenses.

When you travel to Saudi Arabia, for instance, you’ll need insurance when you apply for a visa. It’s typically embedded into the visa application process to ensure you are covered when you visit.

What are your options for health insurance providers in Saudi Arabia? Here’s what you need to know about Saudi visa insurance.

Coverage

Travel insurance covers financial losses incurred while traveling domestically or internationally. It can be particularly helpful in situations such as when you lose your luggage or if these get stolen, when you miss your flight, have delayed flights, or if you get into an accident.

Medical or health insurance, on the other hand, covers the cost of healthcare, medical, and surgical expenses. These may apply to the cost of doctor’s consultation fees, laboratory and diagnostic tests, certain medical procedures, and some medication.

In most cases, travel and medical insurance are lumped together as travel insurance with medical coverage. This provides a combination of comprehensive medical coverage, personal accident benefits, travel assistance, as well as coverage for your belongings, and refunds on non-refundable expenses such as canceled or delayed flights.

Obtaining insurance

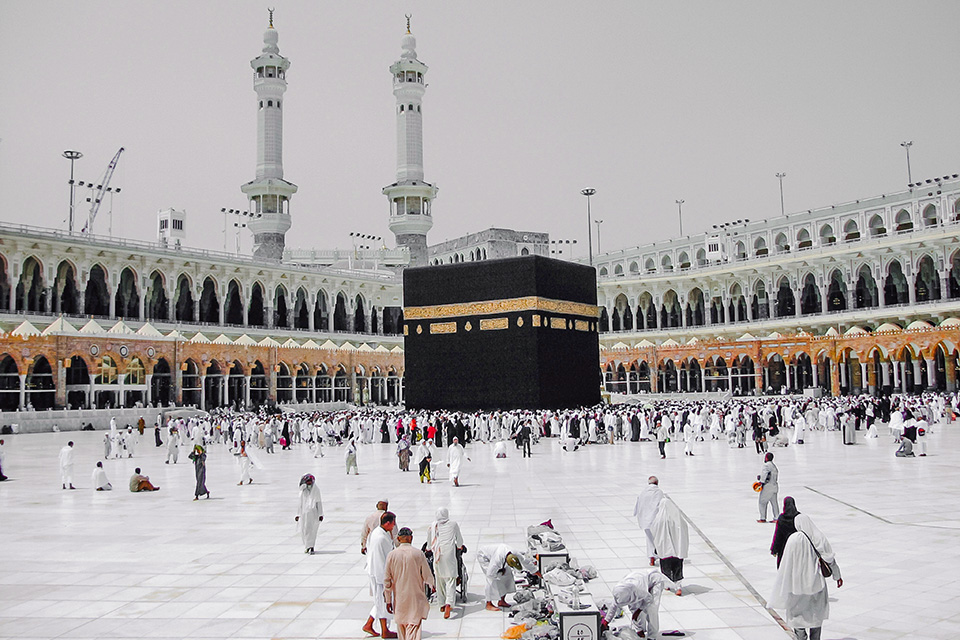

According to Saudi Arabia’s Council of Health Insurance (CHI), health insurance is mandatory if you are applying for a tourist visa, visit visa, Umrah visa, or Hajj visa. As part of your visa application, you’ll be asked to select from a list of Saudi health insurance providers before paying the visa fees.

Once your visa is issued, your health insurance will automatically be activated. The health insurance will cover in-patient treatment (including the cost of COVID-19 treatment) and all health emergencies by a network of approved healthcare service providers.

Here’s an overview of what Saudi visa insurance typically covers:

- Medical examination, diagnostic tests, medication

- Hospitalization in a shared room

- Urgent cases of dental and gum treatment

- Emergency kidney dialysis

- Emergency medical evaluation

- Treatment for car accident injuries

- Emergency pregnancy and childbirth

- Care for premature infants

- Repatriation of remains

You can access the list of Saudi Arabia’s healthcare service providers on the CHI website and filter them by service provider type (ex: pharmacies, doctor’s offices, ambulance service centers, radiology centers, etc.), city, region, and accreditation number. On the same page, you can also inquire about your visa insurance.

Insurance fees

The cost of Saudi visa insurance—also known as visitor health insurance—varies and depends on the health insurance provider that you select. The premiums will also depend on factors such as your age, the duration of the trip, and the type of coverage offered by the insurance plan.

Frequently Asked Questions

Can I extend my Saudi visa insurance?

Yes, you can extend your Saudi visa insurance. If you need to extend your stay in Saudi Arabia, you’ll need to renew your insurance, which will require the selection of a health insurance provider.

Licensed insurance companies include Tawuniya, Bupa, Medgulf, GulfUnion, Arabian Shield Cooperative Insurance, Arabia Cooperative Insurance, Al-Etihad Cooperative, Al-Sagr Cooperative Health Insurance, AXA Cooperative, Allied Cooperative Insurance Group (ACIG), Al-Rajhi Takaful, Walaa, and Saudi Enaya.

Do I need medical insurance to apply for a tourist visa?

Yes, it is necessary to get medical insurance when you apply for a tourist visa. The health insurance policy will be issued along with your Saudi tourist e-visa once it is issued. This includes COVID-19 medical treatment and is valid for one year from the date of its issuance. To inquire about health insurance policy and healthcare service providers, visit the Council of Health Insurance’s website.

What is the coverage amount of Saudi visa insurance included in my tourist visa?

The Saudi tourist e-visa already includes health insurance with a coverage of SAR 100,000 ($26,664.78). For a list of the included hospitals, please contact your insurance provider.

How can I inquire about my insurance provider?

To inquire about your health insurance provider, visit the website of Saudi Arabia’s Council of Health Insurance (CHI) and input your passport number in the field provided, followed by the captcha code. The website will then generate the name of the insurance company, your insurance policy number, and the policy’s expiry date.

Do you need to pay a deductible or a co-payment when you go to an authorized health insurance provider?

No, it is not necessary to pay a deductible or a co-payment when you visit an authorized health insurance provider such as a pharmacy, doctor’s office, or an ambulance service center.

Can the healthcare service provider make me pay in cash if they haven’t received approval yet from the insurance company?

No, the healthcare service provider cannot force you to pay in cash if there has been no approval yet from the insurance company. This goes against the rules of Saudi Arabia’s Council of Health Insurance and the service provider is mandated to provide the necessary healthcare service and inform the insurance company within 24 hours of receiving the policyholder.

What do you need when you visit an authorized healthcare service provider?

You just need your passport number or your insurance policy number when you visit an authorized healthcare service provider.

What is the process when an authorized healthcare service provider receives an emergency case?

Authorized healthcare service providers follow a hierarchy when responding to an emergency case: 1) resuscitation, 2) emergencies, and 3) urgent cases that can lead to the patient’s loss of an organ, disability, or death. The handling of emergency cases will be up to the emergency doctor on duty, and the authorized healthcare service provider does not need to consult the insurance company.

Do you get a copy of your health insurance policy when your Saudi visa is issued?

No, you do not get a copy of your health insurance policy when your Saudi visa is issued. You may download a PDF file copy of it using the same account with which you applied for a Saudi visa

What if I made a mistake in my personal information that didn’t show up in the visa but showed up in the insurance policy?

If you indicated the wrong gender, passport number, or date of birth, then you will need to cancel the visa and apply for a new one.

What types of visas require insurance coverage in Saudi Arabia?

You will typically be required to get insurance coverage in Saudi Arabia if you are applying for a work visa, a residency visa, or a visit visa. Note, though, that the requirements will vary depending on the type of visa you are applying for, as well as from which country you are originally from.

How do I obtain Saudi visa insurance?

If you are applying for a Saudi e-visa, then the system will require you to select from available health insurance providers before you complete the application process. If, however, you are working in Saudi Arabia, then your Saudi visa insurance will typically be set up by your employer or sponsor before you travel to the country.

Do I need to purchase insurance from a specific provider?

Although some employers or sponsors may prefer certain health insurance providers, you have the freedom to choose which insurance company you like. Just make sure that it meets the minimum requirements of the Saudi authorities and provides you with adequate coverage suitable for your needs.

What are the minimum coverage requirements for Saudi visa insurance?

The minimum coverage requirements for Saudi visa insurance will vary depending on factors such as your type of visa, your country of origin, as well as your age. This minimum coverage typically already includes the amounts for hospitalization and medical expenses, on top of other benefits.

Can I use my existing insurance policy from my home country?

There are occasions when you may be able to use an existing international health insurance policy if you have one, as long as it meets the requirements of a Saudi visa. Note, though, that you should confirm with your employer or sponsor as well as the Saudi embassy or consulate in your country of origin that this international health insurance policy meets the required criteria.

What happens if I don’t have valid insurance coverage for my Saudi visa?

If you are applying for an e-visa, it would not be possible to complete the application if you do not select a health insurance provider.

In some cases, you may need to obtain your health insurance and if you don’t have valid coverage, this may result in delays or the denial of your visa application. To avoid any problems, you must have the necessary insurance coverage available before you travel to Saudi Arabia.

Do I need health insurance if I’m extending my stay in Saudi Arabia?

Yes, it is a must to have health insurance if you are extending your stay in Saudi Arabia. You should purchase travel insurance to ensure a smooth journey.

How do I claim insurance if I have a Saudi visit visa?

If you are a Saudi visit visa holder, you can claim with the insurance company by visiting the website of Saudi Arabia’s Council of Health Insurance and making an inquiry about their insurance services. You will be asked for your passport number and insurance policy number to request a service.

How long does it take insurance companies to approve requests for treatment coverage?

The insurance company must respond to such requests for treatment coverage within 60 minutes.

Do health insurance policies cover the claims arising from congenital malformations?

No, the health insurance policy does not cover claims brought about by congenital malformations.

Conclusion

Health and medical insurance is a must for any traveler visiting the Kingdom of Saudi Arabia. According to the country’s Council of Health Insurance, it is mandatory for tourist visas, as well as other types of visit visas. For foreign workers, their health insurance policy is typically arranged by their employer or sponsor.

The premiums of the health insurance plan will vary depending on factors such as the type of visa, the duration of your trip, and the coverage offered by the insurance provider.

Image by pikisuperstar on Freepik